Business Insurance: Types, Coverage & How to Choose

Business insurance helps protect your company from financial losses caused by common risks like customer injuries, property damage, lawsuits, employee injuries, cyber incidents, and unexpected downtime. Whether you run a small shop, a home-based business, an online store, or a service company, the right coverage can prevent one incident from wiping out months (or years) of progress.

Insurance needs vary by country and industry, but the foundation is the same: identify your biggest risks, understand what each policy covers, and choose limits that match how your business actually operates.

- Business Insurance for Home-Based Business

- Mobile Repair Business Insurance (Guide)

- EV Insurance Premiums: Cost Factors + Savings

- Academy Insurance / Educational Institution Guide

What business insurance can cover (and what it usually doesn’t)

Most business policies are designed to handle specific categories of risk. Depending on your coverage, business insurance may help pay for:

- Legal defense costs and settlements

- Medical bills if someone is injured due to your business

- Repairs or replacement of business property (building, tools, inventory)

- Lost income if your operations temporarily stop after a covered event

- Data breach response costs and cyber extortion events (in cyber policies)

However, many policies also have exclusions. Common exclusions may include:

- Intentional acts and fraud

- Normal wear and tear / poor maintenance

- Some types of professional mistakes (unless you have professional liability)

- Certain cyber incidents (unless you have cyber coverage)

- Floods/earthquakes (often require separate add-ons or separate policies)

Always check the policy wording, endorsements, and exclusions list before buying.

Who needs business insurance?

Most businesses benefit from coverage if you have any of the following:

- You interact with customers in person (store, office, client site)

- You sign contracts (clients often require proof of insurance)

- You own valuable equipment, stock, or a workspace

- You have employees or contractors

- You handle customer data, payments, or sensitive information

- You want protection from downtime due to fire, theft, or other disruptions

Even freelancers and solo founders often need at least basic liability coverage—especially when working with business clients.

Common types of business insurance (explained simply)

Here are the most common policies business owners consider:

1) General Liability Insurance

Covers third-party bodily injury, property damage, and some legal costs. Example: a customer slips in your shop or you accidentally damage a client’s property.

2) Professional Liability (Errors & Omissions / E&O)

Helps cover claims of mistakes, negligence, or failure to deliver a professional service. This is essential for consultants, agencies, freelancers, and service providers.

3) Commercial Property Insurance

Protects business property such as equipment, inventory, furniture, and sometimes the building (depending on policy). Useful for stores, offices, and businesses with tools/stock.

4) Business Interruption Insurance

Helps replace lost income if your business must close temporarily after a covered event (like a fire). Often bundled with property coverage or included in a BOP.

5) Workers’ Compensation

Often required if you have employees (rules depend on your country/region). Helps cover medical costs and lost wages for workplace injuries.

6) Commercial Auto Insurance

For vehicles used for business purposes. Personal auto policies can deny claims if the car is used mainly for business.

7) Cyber Liability Insurance

Helps with costs after a data breach, ransomware, or cyber incident. Useful if you collect customer data, run an online store, or store client records.

8) Product Liability Insurance

For businesses that manufacture, distribute, or sell physical products. Covers claims related to injuries or damage caused by products.

9) Business Owner’s Policy (BOP)

A bundle that commonly combines general liability + commercial property (and sometimes business interruption). Often a cost-effective starting point for small businesses.

How to choose the right business insurance (quick checklist)

Use this checklist before you purchase:

- List your top 3 risks: lawsuits, theft/fire, downtime, data breach, employee injury

- Check contracts: clients/landlords may require certain coverage limits

- Decide what must be insured: inventory, tools, computers, vehicles, office space

- Choose realistic coverage limits: match your revenue, assets, and client exposure

- Review exclusions and add-ons: don’t assume everything is covered

- Compare quotes using the same inputs: same limits, deductibles, and coverage types

- Understand the deductible: higher deductible usually lowers premium

- Keep proof of insurance: many clients request a COI (certificate of insurance)

How claims usually work (high-level)

Claims processes vary by insurer and country, but most follow the same steps:

- Report the incident as soon as possible

- Provide details (date, what happened, who was involved)

- Share documents (photos, invoices, contracts, police report if relevant)

- Insurer reviews coverage + assigns an adjuster (if needed)

- Outcome: approval, partial approval, or denial based on policy terms

Common documents often required:

- Policy number and business details

- Photos/videos of damage (property claims)

- Purchase invoices/receipts (equipment/inventory)

- Client contracts/emails (liability/E&O claims)

- Medical reports (injury claims, where applicable)

- Police report (theft/vandalism claims, if required)

FAQ – Business Insurances

Is business insurance mandatory?

Sometimes. Requirements depend on your country/region, your industry, and contracts. Workers’ comp and commercial auto are common legal requirements in many places.

What’s the best first policy for a small business?

Often general liability first, then add property and professional liability depending on your business type.

Does business insurance cover employee mistakes?

Some mistakes may be covered, but professional errors typically require E&O/professional liability. Always check the policy.

Can I bundle coverage to save money?

Yes BOP bundles are common and can be cost-effective.

Note: Insurance availability, pricing, and legal requirements vary by country and region. Always verify details with your insurer or a licensed professional in your area.

Small Business General Liability Insurance: Coverage, Cost & How to Choose (2026 Guide)

Running a small business is stressful enough without worrying that one accident could wipe you…

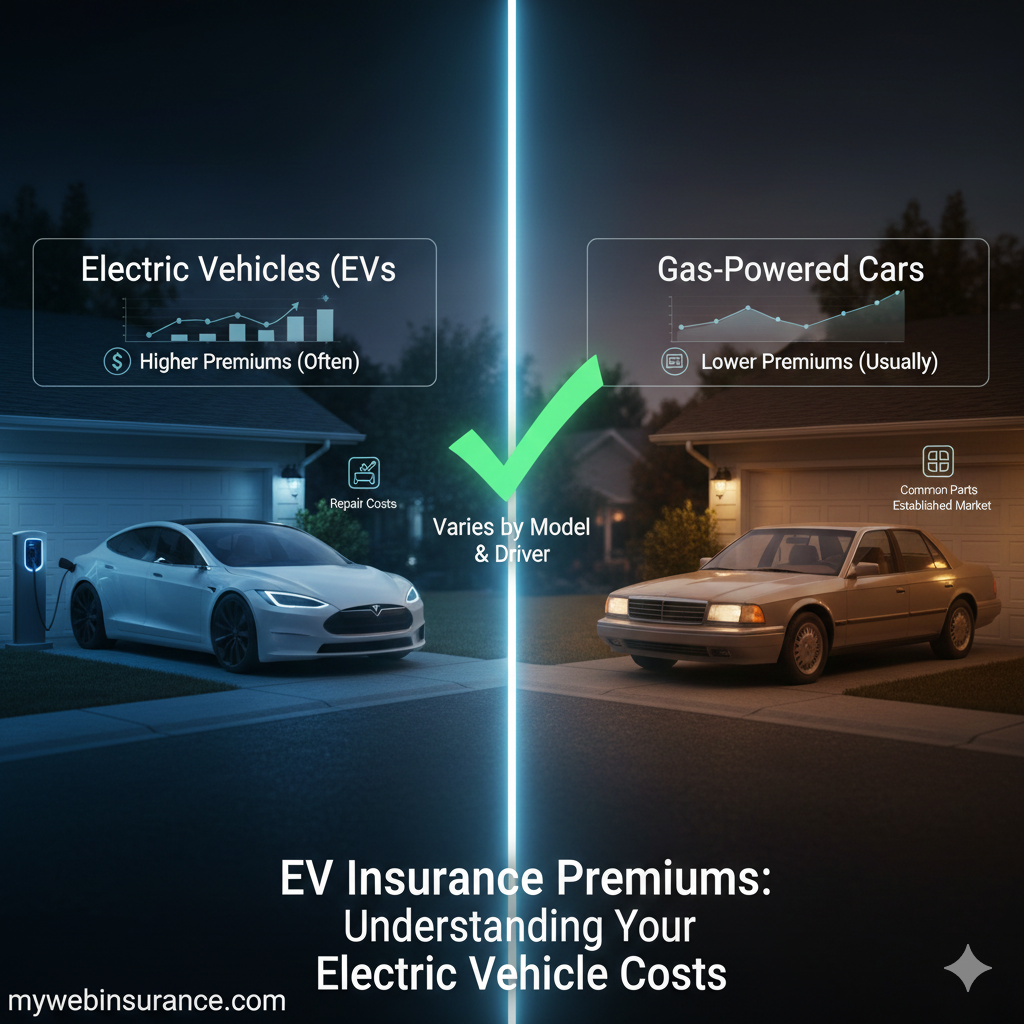

EV Insurance Premiums (2026): Cost Factors, Comparisons + Savings Tips

EV insurance premiums can be higher than insurance for comparable gas vehicles, but the gap…

7 Essential Cyber Liability Insurance Options for Small Businesses in 2026

Understanding Cyber Liability Insurance for Small Businesses Cyber liability insurance for small business has become…

Academy Insurance: Complete Guide to Educational Institution Coverage

Running an academy, school, training center, or other educational institution comes with unique risks: students…

Mobile Repair Business Insurance: Coverage Checklist, Costs + Real Examples (2026)

Running a mobile repair business is a solid business model—low overhead, high demand, and you…

Business Insurance for Home-Based Business: Coverage, Cost + Simple Checklist (2026)

Home based business insurance protects you when homeowners/renters coverage doesn’t fully apply to business activity,…

10 Top Reasons to Choose MyWebInsurance.com Business Insurance in 2026

Introduction In today’s dynamic business environment, protecting your enterprise with the right insurance coverage isn’t…