Group life insurance is life insurance provided through an employer, organization, or association. Many people first get life cover at work because it’s easy, low-cost (sometimes free), and doesn’t require a long application process.

But here’s the key point: group life insurance is usually a great start, not a complete plan. Coverage amounts can be limited, and you may lose the policy when you leave the job.

This guide explains how group life insurance works, what it typically covers, common limits, pros and cons, and how to decide whether you need extra coverage.

Country note: Employer benefits and insurance rules vary by country and provider, but the core structure of group life insurance is similar worldwide.

Part of our Life Insurance Hub >>

Table of Contents

What is group life insurance (simple definition)

Group life insurance is a policy where one “master policy” covers a group of people (employees or members). Instead of each person buying separately, the organization arranges coverage for the whole group.

The insurer prices the group based on overall risk in the group, not only on one person’s health profile (though rules vary).

How group life insurance works (step-by-step)

Here’s the typical setup:

- Your employer offers group life insurance as a benefit

- You enroll during onboarding or annual enrollment

- Coverage starts while you’re employed and eligible

- If you die while covered, beneficiaries can file a claim

- The insurer pays a death benefit (based on policy terms)

Some employers offer a “basic” coverage amount for free and allow you to buy extra coverage (voluntary supplemental coverage).

How much does group life insurance usually cover?

The coverage depends on employer benefit design. Common patterns include:

- A fixed amount (example: 10,000 / 25,000 / 50,000)

- A multiple of salary (example: 1× or 2× annual salary)

- A mix of employer-paid basic + employee-paid extra

Reality check: For families with kids and loans, 1× salary is often not enough. It might cover immediate expenses, but not long-term income replacement.

That’s why people who ask “Is my group life insurance enough?” often end up adding a personal policy.

What group life insurance usually covers

Most group life insurance covers:

- Death from illness or natural causes (while policy is active)

- Death from accidents (while policy is active)

Optional add-ons (vary by employer/insurer) might include:

- Accidental Death & Dismemberment (AD&D)

- Critical illness or disability riders (less common, depends on region)

Always important: group policies still have definitions, exclusions, eligibility rules, and claim document requirements.

Advantages of group insurance (why it’s actually great)

Group life insurance has real benefits:

1) Easy approval

Many plans have simplified enrollment. Some may not require medical exams for basic coverage.

2) Affordable premiums

Employer pricing can be cheaper than buying alone, especially for basic coverage.

3) Automatic coverage (in many workplaces)

Some companies provide it automatically, which is a big win for employees who would otherwise never buy insurance.

4) Great “starter coverage”

If you have nothing else, group life insurance is better than zero protection.

The limitations (what’s missing for most people)

This is where people get surprised.

1) You might lose it when you leave the job

Group life insurance is often tied to employment. If you resign, get laid off, or retire, coverage may end.

2) The coverage amount may be too low

A small benefit might help with funeral costs and short-term bills, but not long-term family support.

3) Portability may be limited (or expensive)

Some plans allow you to “port” or “convert” the policy when leaving. But:

- it may cost more

- the coverage amount may change

- deadlines and rules apply

4) Not fully customized to your personal needs

Group plans are designed for the average employee, not your actual debts, dependents, and goals.

Do you still need personal life insurance?

For many people, yes—especially if you have dependents or loans.

Group life insurance might be enough if:

- You’re single with no dependents

- You have strong savings and minimal debt

- Your employer coverage is unusually high (and stable)

You likely need extra coverage if:

- You have children or a dependent spouse/parents

- You have a mortgage or major loans

- You’re the main income earner

- Your employer coverage is 1× salary or a small fixed amount

- You change jobs often

A common strategy is:

- Keep group life insurance as a bonus

- Buy a personal term policy to cover the “real needs”

How to calculate the gap (simple method)

If you already published your calculator post, link it here.

Basic gap method:

- Estimate how much coverage you need (expenses + debt + goals − savings)

- Subtract your employer group coverage

- The remaining amount is your coverage gap

Example:

- You need: 300,000

- Employer group provides: 50,000

Gap = 250,000

Common questions to ask HR (very practical)

Tell your readers to ask HR these questions:

- How much group life insurance do I have right now?

- Is it a fixed amount or salary multiple?

- Who is my beneficiary on file? Can I update it online?

- What happens to coverage if I leave the company?

- Can I convert or port it? What’s the deadline?

- Are there exclusions or waiting periods?

- Can I buy extra coverage? Does it require medical underwriting?

Claims: what documents beneficiaries may need

Common documents include:

- Claim form

- Death certificate

- Beneficiary ID

- Employee details and employer confirmation (often required)

- Policy/member information

Because employers are involved, some claims require HR verification—so timelines can depend on paperwork speed.

FAQ – Group Life Insurance

Is group life insurance the same as term life insurance?

It can be term-like in function (death benefit protection), but it’s structured as a group plan and tied to employment eligibility.

Is employer life insurance enough?

Sometimes, but often not for people with dependents and debts. Use a calculator method to estimate your needs and find the gap.

What happens to group insurance when I change jobs?

In many cases it ends. Some plans allow portability or conversion, but rules and costs vary.

Can I have group life insurance and personal life insurance?

Yes. Many people use both: group coverage as a bonus and a personal term policy as the main protection.

Does group insurance require a medical exam?

Basic coverage often doesn’t. Higher voluntary coverage may require health questions or underwriting depending on insurer.

Related Guides (Life Insurance)

Life Insurance for Parents: How Much You Need + Best Type to Buy

If you’re a parent, you’re basically running a tiny company: payroll (your income), operations (childcare),…

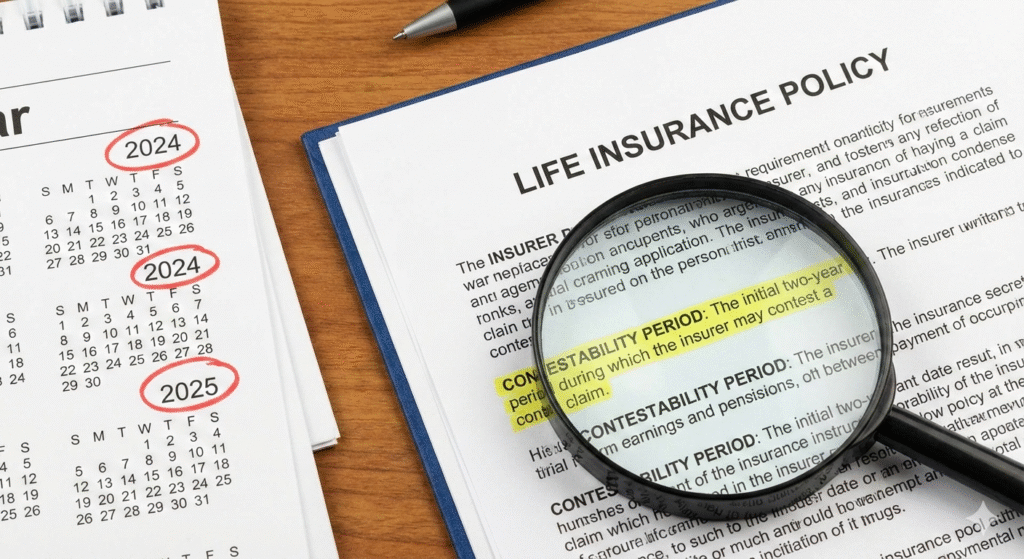

Life Insurance Contestability Period: The 2-Year Rule Explained (2026)

The life insurance contestability period is a time window—often two years from the policy start…

How Long Does It Take to Get Life Insurance Money? Typical Timeline + Delays (2026)

How long does it take to get life insurance money? In many normal cases, beneficiaries…

Does Life Insurance Go Through Probate? When It Does and How to Avoid Delays (2026)

Does life insurance go through probate? Most of the time, no. If a life insurance…

Is Life Insurance Taxable? 9 Situations When You Might Owe Taxes (2026 Guide)

Is life insurance taxable? In most cases, the life insurance death benefit paid to a…

Does Life Insurance Cover Suicide? (2026) Exclusion Period, Claim Rules + What Families Should Do

Does life insurance cover suicide? Yes, in many cases—but many policies include a suicide exclusion…