If you’re asking how much life insurance do I need, you’re already doing the smartest thing: planning with numbers instead of guessing. Life insurance isn’t about buying the “maximum.” It’s about buying enough coverage so your family can keep living normally if your income disappears.

This guide gives you a simple calculator method, real examples, and a checklist so you can choose an amount that actually makes sense. If you’re asking how much life insurance do I need, the best approach is to calculate your family’s expenses, debts, and the number of years they would need support.

Country note: Costs, taxes, and product rules vary by country. The method below is universal, but always confirm local details with official documents or a licensed professional.

Part of our Life Insurance Hub >>

Table of Contents

The simple rule: replace what your family would lose

Most people need life insurance for one (or more) of these reasons:

- Replace income for dependents (spouse/kids/parents)

- Pay off debts (mortgage, loans)

- Cover final expenses (funeral, immediate bills)

- Fund goals (education)

So the core question is: If you’re not here, how much money does your family need to stay stable for the next X years?

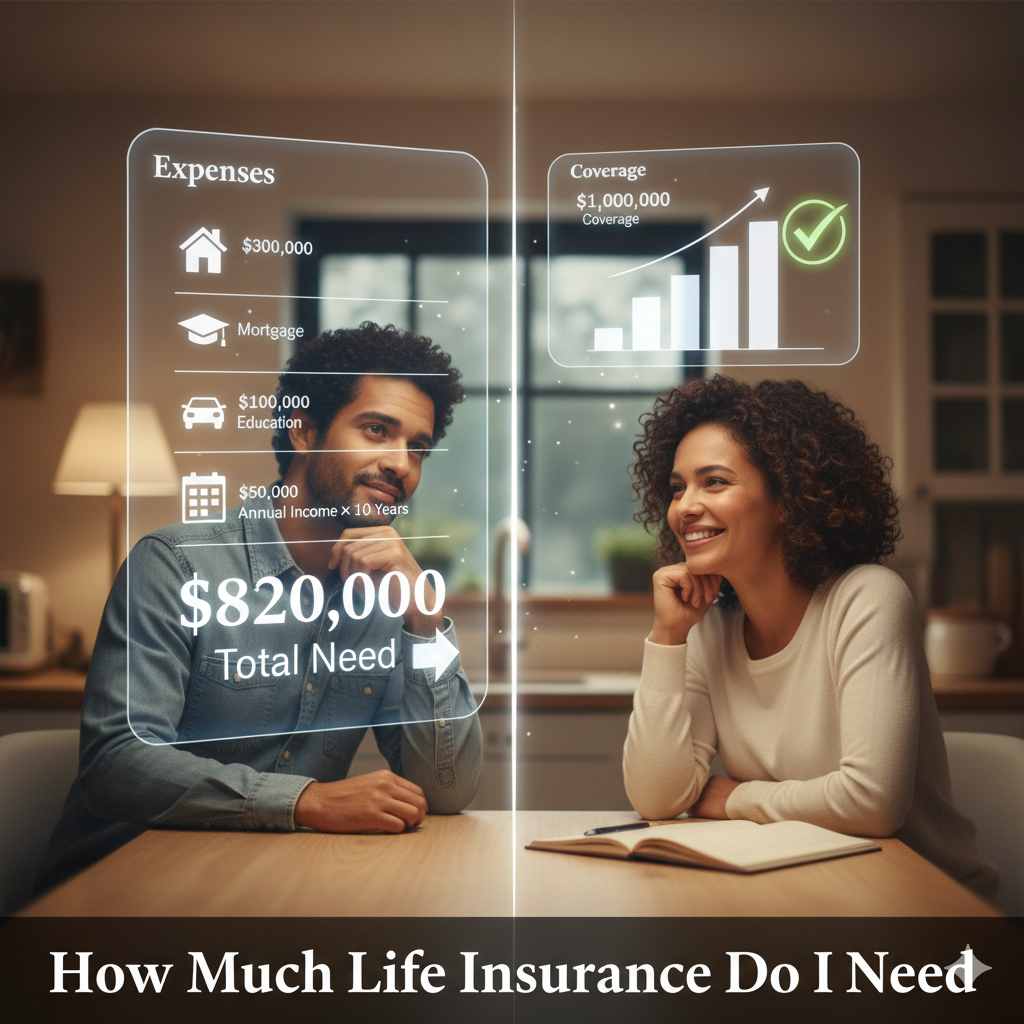

A simple life insurance calculator (easy formula)

This method answers the question how much life insurance do I need using real numbers instead of guessing. Here’s a practical way to estimate coverage:

Coverage Needed = (Annual expenses × Years to protect) + Debts + One-time costs − Savings/Assets

Where:

- Annual expenses = the amount your family needs each year to live

- Years to protect = how long you want to provide support

- Debts = mortgage + loans you want cleared

- One-time costs = funeral + emergency fund + education goals

- Savings/Assets = money your family already has available

This method works because it forces you to think like a household CFO (without the spreadsheet headache).

Step-by-step: calculate your coverage in 10 minutes

Step 1: Estimate your family’s annual expenses

Include realistic essentials:

- Housing / rent / mortgage

- Food and utilities

- Transportation

- School costs/fees

- Healthcare expenses not covered elsewhere

- Basic lifestyle costs (keep it honest, not perfect)

Tip: If you don’t know the exact number, use your household’s yearly spending or monthly budget × 12.

Step 2: Choose how many years you want to protect

Most people choose:

- Until kids become financially independent

- Until a mortgage is paid off

- Until a spouse reaches a stable income or retirement plan

Common ranges:

- 10 years (short protection)

- 15–20 years (common for parents)

- 25–30 years (young families with big loans)

Step 3: Add debts you want to clear

List the debts you don’t want your family to struggle with:

- Mortgage/home loan

- Car loan

- Personal loans

- Business loan (if it affects household)

- Other obligations (varies by country)

Step 4: Add one-time costs

Common one-time costs:

- Funeral and end-of-life costs

- Emergency fund (3–12 months expenses)

- Education fund (if that’s a goal)

- Relocation costs (if family might move)

Step 5: Subtract savings and assets

Subtract money your family can already access:

- Savings

- Fixed deposits/investments (if accessible)

- Employer death benefits (if reliable)

- Existing life insurance policies

Be conservative. Don’t assume “future returns” will magically solve it.

Examples: how much life insurance do I need?

Example 1: Single person, no dependents

For parents, the question how much life insurance do I need usually comes down to income replacement plus debts and education goals. If you have no dependents, you may only need enough to cover:

- Funeral costs

- Any debts with a co-signer

- Financial support for parents (if applicable)

Example numbers

- Funeral costs: 5,000

- Debt: 10,000

- Savings: 3,000

Coverage ≈ 12,000

In this case, a small policy may be enough (or none, depending on your situation).

Example 2: Married couple, no kids (shared mortgage)

You may want coverage that pays off the mortgage and gives your spouse time to adjust.

Example numbers

- Annual expenses: 18,000

- Years to protect: 5

- Mortgage: 60,000

- One-time costs: 7,000

- Savings: 20,000

Coverage = (18,000 × 5) + 60,000 + 7,000 − 20,000

Coverage = 90,000 + 60,000 + 7,000 − 20,000 = 137,000

Example 3: Parent with two kids

This is where life insurance is most important: income replacement + stability.

Example numbers

- Annual expenses: 22,000

- Years to protect: 15

- Debts: 40,000

- Education fund: 20,000

- One-time costs: 8,000

- Savings: 25,000

Coverage = (22,000 × 15) + 40,000 + 20,000 + 8,000 − 25,000

Coverage = 330,000 + 40,000 + 20,000 + 8,000 − 25,000 = 373,000

How to choose the right term length after you calculate coverage

Once you have your amount, pick a term that matches your responsibility timeline:

- Mortgage remaining years = good term length target

- Kids current ages → choose coverage until they’re adults

- If you’re early in career, give yourself enough runway (20 years is a common sweet spot)

What changes your number (common situations)

Your needed coverage increases if you:

- Have young children

- Have a mortgage or large loan

- Have a single income household

- Support parents or family members

- Have a business that depends on you

Your needed coverage may be lower if:

- You have high savings and investments

- Your spouse has strong independent income

- You have reliable employer coverage (still double-check portability)

Quick “don’t mess this up” checklist

Before you buy, confirm:

- Beneficiaries are correct and updated

- You understand exclusions and waiting periods

- Premiums are affordable long-term

- You’ve matched term length to your real timeline

- You’re not relying only on employer group life (often limited)

FAQ: How much life insurance do I need?

Is 10x salary enough?

It’s a popular shortcut, but it can be wrong. It ignores debts, savings, lifestyle, and how many years your family needs support. Use the calculator method for better accuracy.

Do I need life insurance if I don’t have kids?

If someone depends on your income (spouse/parents) or you have shared debts, life insurance can still be important.

Should I choose term or whole life for this coverage amount?

For most families, term life is the most affordable way to buy the coverage amount you actually need.

Can I start small and increase later?

Yes, but premiums often rise with age. Many people buy enough early, then adjust later as responsibilities change.

What if I already have employer life insurance?

Treat employer coverage as a bonus, not your main plan—especially if it ends when you change jobs.

Pingback: Life Insurance Rates by Age (2026): What Affects Cost + Example Chart

Pingback: Life Insurance for Seniors (2026): Best Options, Costs + What to Avoid

Pingback: Life Insurance Beneficiary Rules (2026): How It Works + Common Mistakes

Pingback: Life Insurance Exclusions (2026): What’s Not Covered + Common Denial Reasons