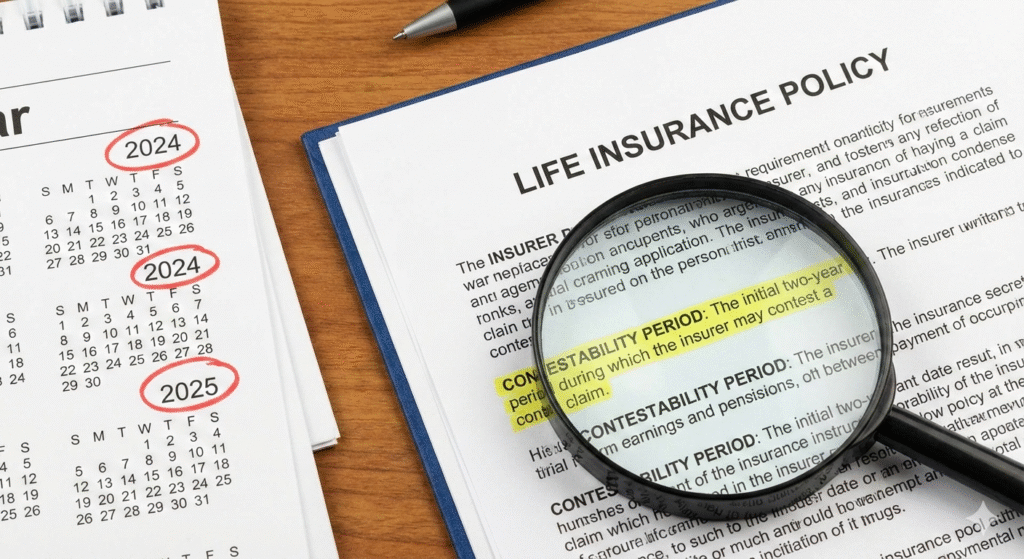

The life insurance contestability period is a time window—often two years from the policy start date—when the insurance company can take a closer look at a claim and verify the information on the original application.

This doesn’t mean the insurer is “trying not to pay.” It means they’re checking whether the policy was issued based on accurate information. If everything checks out, the claim is usually paid. If not, the claim can be delayed, reduced, or denied.

Note: Rules can vary by state and by policy. This is general U.S.-focused info, not legal advice.

Table of Contents

What is the life insurance contestability period?

The life insurance contestability period is typically the first 2 years after your policy becomes active.

During this time, if the insured dies, the insurer may:

- request additional documents (medical records, prescriptions, application details)

- verify statements on the application

- investigate whether any important information was incorrect or missing

After the contestability period ends, insurers generally have fewer reasons to challenge a claim—except in cases like fraud.

The “2-year rule” in plain English

If death happens within the first 2 years, the insurer may review the claim more aggressively.

If death happens after 2 years, the claim is often more straightforward—assuming the policy was active and premiums were paid.

Key point: Contestability is about application accuracy, not about the cause of death alone.

What can trigger a contestability review?

Here are the most common triggers that cause extra scrutiny:

1) Death occurs soon after the policy starts

If a policy is new, insurers often do routine verification.

2) Medical history details don’t match records

Example triggers:

- undisclosed smoking/vaping

- missing diagnoses (diabetes, heart disease, cancer history)

- unreported medications or treatments

3) High coverage amounts or unusual changes

Big policies can lead to more verification, especially if the policy was recently increased.

4) Application answers that look inconsistent

Even small inconsistencies can cause delays if the insurer needs clarification.

What is “material misrepresentation”?

A material misrepresentation is incorrect or missing information that would have affected the insurer’s decision to:

- approve the policy,

- set the premium price, or

- set coverage limits.

Not every mistake is material.

Example:

- Wrong height by an inch is usually not a big deal.

- “Non-smoker” when the person used nicotine regularly can be a big deal.

What happens if the insurer finds an issue?

If the insurer believes the policy was issued based on inaccurate information, outcomes may include:

1) The claim is still paid (best case)

If the info wasn’t material or doesn’t change the underwriting outcome.

2) The claim is adjusted (partial reduction)

If the insurer determines coverage would have been lower based on accurate info.

3) The claim is denied

If the misrepresentation was material and would have changed approval/pricing.

4) Premiums may be refunded

In some denial scenarios, insurers may refund premiums paid (details depend on policy and circumstances).

Contestability period vs suicide clause (they’re not the same)

People confuse these a lot.

- Contestability period: insurer reviews application accuracy (often 2 years)

- Suicide clause: specific exclusion period for suicide (often 2 years)

They can overlap, but they are different rules with different purposes.

Can a claim be denied after the contestability period ends?

It’s harder, but not impossible.

Even after the contestability period, insurers may deny claims in situations like:

- proven fraud

- policy lapse (premiums not paid, coverage ended)

- beneficiary issues or legal disputes

- exclusions clearly stated in the policy

So “after two years” usually reduces friction, but it doesn’t eliminate all claim problems.

How to avoid contestability issues (practical checklist)

If you’re buying life insurance now:

1) Be accurate on the application

Answer health and lifestyle questions honestly, even if it feels awkward.

2) Don’t “guess” on medical history

If you’re unsure, check your records or ask your doctor. Accuracy is your friend.

3) Don’t let your policy lapse

A lapse can create bigger problems than almost anything else.

4) Keep copies of what you submitted

Save the application summary if your insurer provides it.

5) Update beneficiaries (separate issue, but huge)

Wrong beneficiaries don’t trigger contestability, but they absolutely trigger delays.

What beneficiaries should do if the death occurred within 2 years

If you’re filing a claim during the contestability period:

1) Submit a complete claim packet (missing docs = automatic delays)

2) Expect the insurer to request medical records

3) Respond quickly and keep a call/email log

4) Ask what the insurer is waiting for and when they expect a decision

5) If the claim is denied, request the denial reason in writing and consider professional advice if the decision seems wrong

FAQ – Life Insurance Contestability Period

What is the life insurance contestability period?

The life insurance contestability period is usually the first two years of a policy when the insurer can review the application details more closely if a claim occurs.

Is the contestability period always 2 years?

Often it’s two years, but it can vary by state and policy terms. Check your policy contract for the exact period.

What happens if someone dies during the contestability period?

The insurer may request additional documentation and verify application information before paying the claim.

Can life insurance deny a claim after 2 years?

It’s less common, but claims can still be denied for reasons like fraud, policy lapse, or clear policy exclusions.

Does the contestability period mean the policy won’t pay?

No. Many claims during the contestability period are still paid—review just takes longer.

Key takeaways

- The life insurance contestability period is usually the first 2 years after the policy starts.

- If death happens during this window, insurers may request more documents and verify application info.

- Accurate applications + active coverage are the fastest path to smooth payouts.