Types of life insurance can feel like a menu with way too many options—term, whole, universal, group, accidental, final expense… and suddenly you’re Googling at 2AM like it’s an exam tomorrow. The good news: most people only need to understand a few core types to make a smart choice.

This guide explains the main types of life insurance in plain language, with real examples, pros/cons, and a simple checklist to pick what fits your life. In this guide, we’ll break down the types of life insurance in simple terms, so you can choose the right policy without confusion.

Country note: Names and exact features can vary by country and insurer, but the basic concepts below apply worldwide. Always verify details in the official policy document.

Table of Contents

Quick overview: the 2 big categories

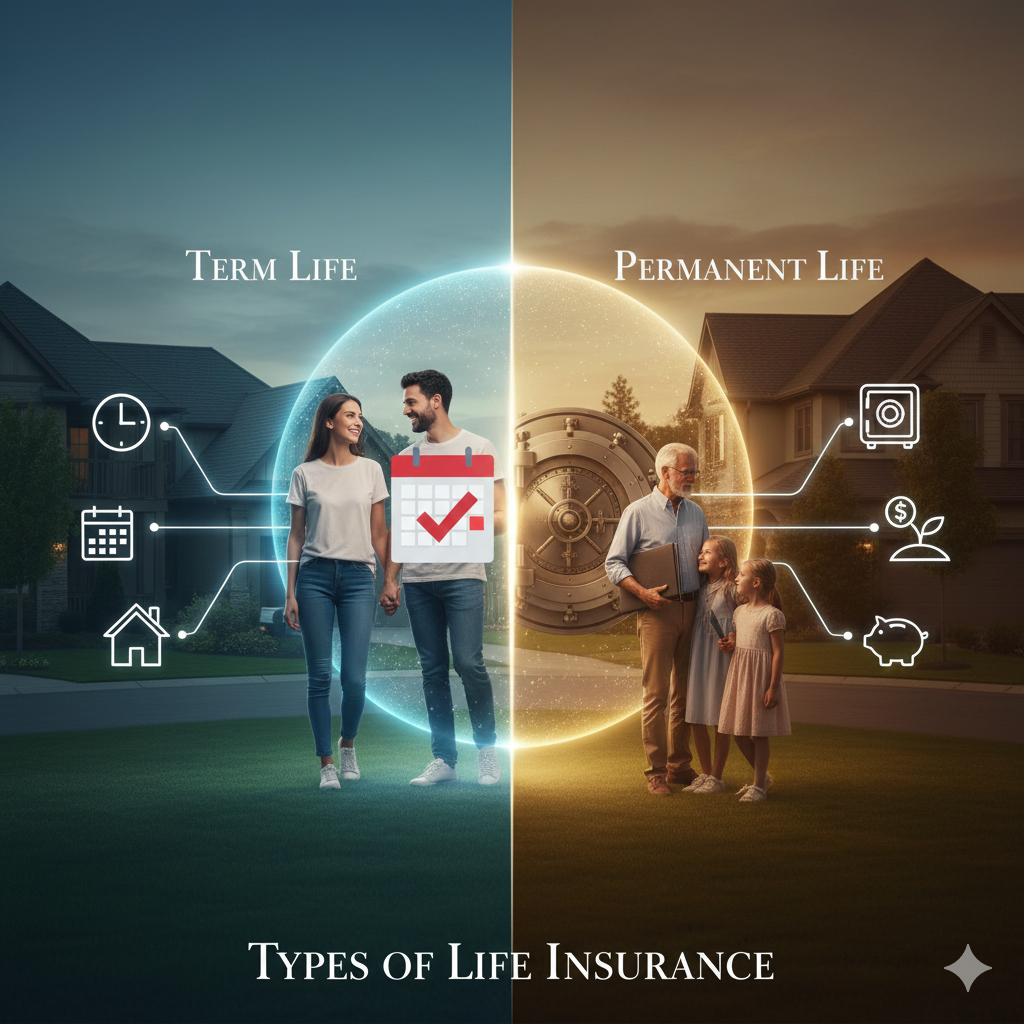

The types of life insurance generally fall into two main categories: term life and permanent life. Almost every policy fits into one of these buckets.

- Term life insurance (coverage for a set number of years)

- Permanent life insurance (coverage intended to last for life, often with extra features like cash value)

If you remember nothing else, remember this:

Term = simple + affordable. Permanent = longer-term + pricier + more complex.

Comparison table (fast clarity)

| Type | What it is | Best for | Main downside |

|---|---|---|---|

| Term Life | Coverage for 10/20/30 years | Most families | Ends after term |

| Whole Life | Permanent coverage + cash value (in many markets) | Long-term planning (specific cases) | Expensive |

| Universal Life | Permanent coverage with flexible features (varies) | Advanced planning | Complexity/risks |

| Group Life | Employer-provided life cover | Basic starter cover | Often low limits |

| Final Expense | Smaller policy for funeral costs | Seniors/low coverage needs | Higher cost per $ coverage |

| AD&D | Pays for death/serious injury from accidents only | Add-on protection | Very limited coverage |

1) Term life insurance (the “get the job done” option)

Term life insurance covers you for a specific period (example: 20 years). If you die during the term, your beneficiaries get the payout (death benefit). If you outlive the term, coverage usually ends unless you renew or convert (if your policy allows it).

Why people choose it

- Usually the most affordable way to get high coverage

- Perfect for “responsibility years” (kids, loans, mortgage)

- Simple structure = fewer surprises

Real-life example

You’re 30 with a new family and a home loan. You buy a 20-year term so your family is protected until your kids are adults and the loan is mostly paid.

Common term variations

- Level term: premium stays the same (common)

- Renewable term: renewal possible but price increases with age

- Convertible term: can convert to permanent later (rules apply)

- Decreasing term: payout reduces over time (some people match it to mortgage)

Best for: most people who want maximum protection for a reasonable cost.

2) Whole life insurance (permanent + usually includes cash value)

Whole life insurance is designed to last your entire life (as long as premiums are paid). In many countries, it may include a cash value component that grows over time.

Pros

- Lifetime coverage (no “term ends” problem)

- Can build cash value (policy-dependent)

- Predictable structure in many cases

Cons (the part people feel later)

- Premiums are usually much higher than term for the same payout

- Cash value features vary and can be misunderstood

- Not always the best “first policy” if budget is limited

Real-life example

A person wants lifetime coverage for estate planning or long-term dependents and can comfortably afford higher premiums.

Best for: specific long-term needs, not the default choice for everyone.

3) Universal life insurance (flexible, but read the fine print)

Universal life insurance is a form of permanent insurance that can include flexible premiums and a cash-value-like component (depending on country and product). There are variations (like indexed or variable versions in some markets), and they can be complex.

Pros

- More flexibility than whole life (in some products)

- Potential for cash value accumulation (policy-dependent)

Cons

- Complexity = easy to misunderstand

- Performance/fees/requirements can change outcomes

- Not ideal if you want “set it and forget it” simplicity

Best for: people who understand the product well and need flexibility—often after they already have basic coverage.

4) Group life insurance (through employer)

Group life insurance is coverage offered by your employer or organization. It’s often low-cost or free, and it can be a good baseline.

Pros

- Easy to get (often no medical exam)

- Affordable

- Nice benefit for employees

Cons

- Coverage amount is often limited

- May end when you leave the job (portability varies)

- Not customized for your family’s real needs

Real-life example

You have group life worth 1–2 years of salary. Great, but if you have kids and a mortgage, you may still need extra term coverage privately.

Best for: everyone who has access to it—but don’t rely on it alone.

5) Final expense / burial insurance (small coverage, specific purpose)

Final expense insurance is usually a smaller policy designed to cover funeral costs and immediate expenses. It’s often marketed to seniors.

Pros

- Covers a clear need (funeral + short-term costs)

- Sometimes easier approval

Cons

- Higher cost per unit of coverage

- Limits are usually small

Best for: people who mainly want funeral cost coverage and don’t need large income replacement.

6) Accidental Death & Dismemberment (AD&D) (very limited)

AD&D pays out only if death or severe injury happens due to an accident—not illness. Since many deaths happen from illness, AD&D is not a replacement for real life insurance.

Pros

- Cheap add-on

- Can help in specific roles/risks

Cons

- Limited coverage triggers

- Not comprehensive

Best for: optional extra—never the main plan.

7) Mortgage life insurance (or loan protection plans)

Some lenders offer “mortgage life” or loan protection that pays the lender if you die.

Watch-outs

- The beneficiary is usually the lender

- Payout may decrease as the loan reduces

- You may get better value from a standard term policy (often with more flexibility)

Best for: specific cases, but compare carefully.

How to choose the right type (simple decision checklist)

Use this decision flow:

Step 1: Who depends on you?

- Spouse, kids, parents, business partner → you likely need coverage.

Step 2: What’s your goal?

- Income replacement → term life usually wins

- Lifetime planning / long-term dependent → permanent options may matter

- Funeral costs only → final expense may fit

Step 3: How long do you need it?

- Until kids are independent / loans paid → choose term length accordingly

Step 4: Choose affordable premiums you can sustain

A policy you cancel later is basically a budget leak. Better to buy the right amount of term than an unaffordable permanent policy.

What affects premiums (for all types)

Costs depend on:

- Age

- Health history

- Smoking/tobacco

- Coverage amount

- Policy type (term vs permanent)

- Term length

- Job/hobbies risk level

Country note: underwriting rules vary. Some markets require medical tests; some offer simplified issuance (often at higher cost).

What documents are commonly required for a claim?

Once you understand the types of life insurance, it’s much easier to compare plans, avoid costly mistakes, and pick coverage that fits your life. This varies, but commonly:

- Claim form

- Death certificate

- Policy number/details

- Beneficiary ID

- Relationship proof (sometimes)

- Police report (if accidental/required)

- Medical records (if requested)

Having clean paperwork speeds things up.

FAQ – Types of Life Insurance

What are the main types of life insurance?

The main types are term life and permanent life (like whole life and universal life), plus group life and other specialized forms.

Which type is best for most people?

For most families, term life insurance offers the best balance of affordability and coverage.

Is employer group life insurance enough?

Often not. It’s a solid base, but the coverage amount can be too small for a family with loans and dependents.

What’s the difference between whole life and universal life?

Both are permanent types. Whole life is often more structured; universal life may offer more flexibility but can be more complex.

Can I have more than one type?

Yes. Many people combine group life + a personal term policy, or term + permanent (in specific cases).

Related Guides (Life Insurance)

- Life Insurance Hub (Start Here)

- Term vs Whole Life Insurance

- How Much Life Insurance Do I Need?

- Life Insurance Rates by Age

- Life Insurance Exclusions (What’s Not Covered)

- Does life insurance go through probate?

- How Long Does It Take to Get Life Insurance Money?

- Life Insurance Contestability Period

- Life Insurance for Parents

Pingback: Term vs Whole Life Insurance: Differences, Pros/Cons + Best Choice (2026)

Pingback: Life Insurance Rates by Age (2026): What Affects Cost + Example Chart

Pingback: Universal Life Insurance Explained (2026): How It Works, Pros/Cons + Risks

Pingback: Group Life Insurance (2026): What Employer Coverage Includes + What’s Missing

Pingback: Term Life Insurance (2026): What It Is, Cost, Pros/Cons + How to Choose

Pingback: What Is Life Insurance? Simple Definition, Types, Benefits + Examples (2026)

Pingback: Life Insurance for Seniors (2026): Best Options, Costs + What to Avoid

Pingback: Life Insurance Beneficiary Rules (2026): How It Works + Common Mistakes